McKinsey report Quantum technology is expected to create $700 billion in value (1)

Quantum technologies have the potential to solve some of the toughest global challenges, including limiting global warming and reducing the time to drug discovery, and addressing them will be a game-changer.

The latest McKinsey research report, Quantum Technology Monitor, notes that public and private funding continues to soar in order for the technology to live up to its promise. Four industries—pharmaceuticals, chemicals, automotive, and finance—are still expected to be the first beneficiaries of “quantum advantage,” poised to be worth nearly $700 billion as early as 2035.

Quantum technology (QT) is mainly divided into three areas: computing, communication and sensing.

Quantum computing (QC) is a new computing technology: exploiting the laws of quantum mechanics to provide exponential performance improvements for some applications, potentially enabling an entirely new field of computing. Some early quantum hardware products were special-purpose quantum computers, also known as quantum simulators.

Quantum Sensing (QS) is a new generation of sensors built from quantum systems. It can provide measurements of various quantities (eg, gravity, time, electromagnetism) with orders of magnitude higher sensitivity than classical sensors.

Quantum communication (QComms) is the secure transmission of quantum information across space. It is implemented by quantum cryptography, which ensures the security of communication even in the face of unlimited (quantum) computing power.

Since the second half of 2021, IonQ has been successfully listed, becoming the first pure quantum computing company in history; Honeywell Quantum Solutions and Cambridge Quantum merged to form Quantinuum; Rigetti is also working with special purpose acquisition company (SPAC) Supernova Go public after the merger; Origin Quantum has released a roadmap to deliver a 1024-bit quantum computer by 2025; Amazon AWS has opened its quantum computing center at Caltech.

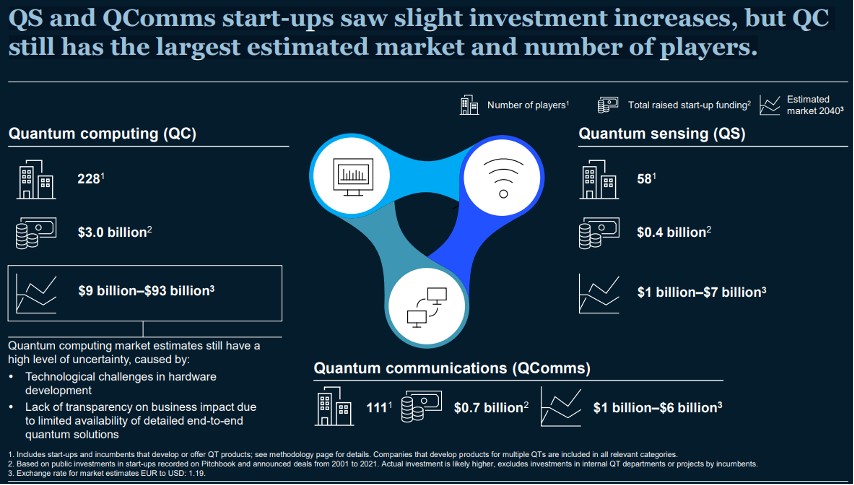

Among different areas of quantum technology, QS and QComms will see the highest increase in funding in the second half of 2021; however, QC still has the most funding ($3 billion since 2001) and companies (228) .

A brief overview of developments in the second half of 2021. It mainly analyzes and summarizes from the perspective of ecological environment construction, capital supply and major events.

Summary of key data for QS, QComms and QC.

In terms of funding, Quantum Technology (QT) startup funding and investment activity exceeded $1.4 billion in 2021 – more than double the amount in 2020. QT funding is also starting to move towards established startups: nearly 90% of funding is for companies with Series A, B, C, and D rounds.

From an industry perspective, the financial and life sciences sectors are likely to see the greatest impact from QC; however, the near-term impact of QC is still expected to be highest in the chemical, pharmaceutical, automotive and financial sectors.

From the perspective of global competition, China's QT activity is accelerating," according to reports, the government's investment is estimated to be as high as 15.3 billion US dollars, more than double the EU government investment (7.2 billion US dollars), and the US government investment (1.9 billion US dollars). more than twice". China has added QT patents in all technology fields, accounting for more than half of the total number of QT patents in the world.

However, the QT market is still mainly concentrated in North America: with nearly 40% of companies and more than 60% of venture capital. Ten of the 12 largest hardware companies are located in North America; China has the broadest commercial implementation of quantum communications, and Japan has the largest number of industry players already adopting QT in their operations.

1) QT startup investment activity in 2021 exceeded $1.4 billion, more than double that of 2020; however, the pace of QT startups has slowed over the past three years.

Based on publicly available investment data recorded in PitchBook. But the actual investment may be higher, as seven of the 20 deals completed in the second half of 2021 did not disclose the size of the deal.

Data sources: Crunchbase, PitchBook, McKinsey

2) Venture capital and other private capital now account for more than 70% of QT's investments, with nearly 90% of the funding going to mature startups (Series A, B, C, and D).

Investment ratio by investor type (left) and deal round (right), 2001-2021.

3) Although the transaction scale is increasing, the focus of the transaction is still mainly on QC hardware.

Top 10 VC/PE investments in QT startups by deal size (in descending order).

4) Most of the investments are still in US companies and driven mainly by private investors.

QT deal size by major investor type, 2001-2021. Unit: US$ million

5) China and the EU have announced plans to provide more public funding for QC work; Germany will provide the most public funding in the EU.

Announced government funding schemes (left); EU sources of public funding in percent (right).

6) Among them, the US government funds more QC work than QComs or QS.

Announced government funding programs (left), U.S. public funding by technology (right).

7) Quantum technology activities in China are accelerating, spurred by government funding.

Data source: IT Orange.

1) In terms of the number of roles involved, the US and Canada are still the most active countries in terms of QC.

Number of quantum computing companies by country.

2) Quantum computing (QC) start-ups continue to emerge worldwide, with the EU and Canada having the most new products.

Number of QC startups by country (2021 and 2015).

3) Most of the players are computing component and application software companies, but hardware startups still get the lion's share of funding.

Number of QC participants by value chain.

4) The growth of publicly announced QC startups has slowed over the past three years. Potential reasons are: lack of talent, the market for hardware solutions is relatively saturated, the current supporting applications are not perfect, investors resist angel investment, etc.

Sources: CapitalIQ, Crunchbase, PitchBook, media searches, quantum computing reports, expert interviews, McKinsey.

5) The QC ecosystem spans hardware and software. However, the core part of the QC ecosystem does not yet have a commercial product, and revenue comes mainly from component vendors, consulting services, and joint research projects.

The funding/income range that defines maturity: $100M+ is high, $1M-$100M is medium, $10K-$1M is low, and less than $10K is very low/unknown.

The component field is the most mature, but there is also room for dedicated players;

Hardware is dominated by big tech companies and a handful of scaled companies, with most of the capital going to superconducting qubits;

The system software market is segmented by full-stack and specialized software players, with most products in the prototype stage;

Despite the large number of participants, the application software is immature and far from saturation;

The service area is divided into consulting services and cloud services.

6) Tech giants dominate in superconducting qubits; newcomers are catching up in ion traps and photonics.

Data sources: Crunchbase, Capital IQ, PitchBook, quantum computing reports, expert interviews, team analysis.

1) QComms startups continue to rise globally, most of them in the US and EU.

Number of QComms startups by country (2021 and 2015).

2) Most of the funds are raised for startups that apply software, although they are relatively small in number.

Number of QComms participants by value chain.

3) The QComms ecosystem is dominated by large technology companies. The core parts of the QComms ecosystem (hardware and software) do not yet have commercial products, and revenue is mainly generated through component vendors, consulting services, and joint research projects.

Overview of QComms participants.

1) The number of QS businesses has almost doubled in the past five years; however, they are still relatively few in number.

Number of QS startups by country (2021 and 2015).

2) Overall investment in QS remains low, with most players and funding concentrated in components.

Number of QS participants by value chain.

3) The QS market is still in the prototype stage. The core parts of the QS ecosystem (hardware and software) do not yet have commercial products, and revenue is mainly generated through component players, consulting services, and joint research projects.

Data sources: CapitalIQ, Crunchbase, PitchBook, Media Search, Quantum Computing Reports, Expert Interviews, McKinsey

1) Quantum computing may impact the chemical, pharmaceutical, automotive and financial industries in the short term. Specifically include:

The impact of quantum computing is expected to be most disruptive to the chemical and pharmaceutical industries, as quantum computing-based simulation of molecular processes may replace the need for laboratory-based testing;

Breakthroughs in battery development and new fuels that could spur development in the automotive industry;

The impact on the financial industry is gradual, but the value involved is high, especially in asset management.

Data sources: Industry reports, McKinsey Technology Council.

2) However, in the long run, the most valuable use cases are likely to be in the life sciences and financial services sectors.

A qualitative estimate of the expected value released by applying QC.

1) China has increased its quantum-related patent activity in all technological fields, largely influenced by Chinese government policies.

Japan has consistently ranked among the top three in QT patent development. Japan's high share of QT patents indicates a high level of adoption in the QT industry; the US and EU are the countries with the largest number of QT patents. Until 2005, the US and EU had the highest number of QT patents, however due to changes in the culture around IP, this number started to decline.

Share of quantum patents by country of company headquarters (2000-2021), unit: 1%.

2) The EU publishes the most articles on quantum topics, but the US leads in the impact of published material. U.S. publications have the highest impact, indicating their leadership in academic research; in 2020, the EU led in the number of articles published in quantum-related fields, followed by China and the United States.

Note: The h-index is the number of articles in a country that have been cited at least h times.

3) However, scientists from Chinese research institutions published the most articles. Scientists at Chinese institutions contributed nearly a quarter of quantum-related academic publications; researchers from US and EU institutions rounded out the top three, accounting for 24% and 22% of quantum-related publication contributions, respectively.

The top 10 countries in the world in 2021, calculated by the share of scientific publications, the contribution of authors of research institutions in the country to quantum-related publications. unit:%

4) The EU has the highest concentration of QT talent. The EU has the largest number of QT-related graduates, followed by India and China; the EU has the highest concentration of quantum-related talent, followed by the UK and Russia.

The absolute number of graduates in QT-related fields in 2019.

5) Few universities offer QT advanced degree programs. Although a considerable number of universities already offer quantum research programs (176), not many of them offer a master's degree in quantum technology (29). Universities generally recognise the need for QT specialists in industry, but have been slow to develop courses that meet this need. American universities account for more than one-third of all universities with QT research programs.

Left: Top 10 countries in the world in 2021 (by number of universities with QT research programs); Right: Universities offering QT master's degrees in 2021.

6) The talent gap for QC jobs can be addressed through upskilling programs. As of December 2021, there are 851 QC vacancies. In contrast, only about 290 graduates each year are ready to fill a position requiring QT skills with little or no training; only about one-third of the market can meet demand; about 35,000 graduate with some QT-related knowledge, This could be a huge potential for upskilling .

Estimates are based on the number of colleges with such programs and the number of students graduating each year. This includes graduates with a master's degree or equivalent in biochemistry, chemistry, electrical and chemical engineering, information and communication technology, mathematics and statistics, and physics.

The competition to lead in QC technology is still up in the air. Most players have invested in photonic, ion trap, spin and superconducting qubit devices, and these players aim to gradually improve their hardware technology and create large-scale quantum computers for commercial applications by 2030.

While the US and Canada have been market leaders for the past decade, China and the EU are determined to catch up and have announced substantial public funding, with more industry players moving from pre-competitive QC exploration to competitive research (partly under "invisibility"). model"). In QComms and QS, many products will move from the prototype stage to commercialization; this may lead to an increase in application and service companies.

Several large investment rounds have been announced since 2021 (e.g., IonQ ~$650 million; ArQit ~345 million; Cambridge Quantum Computing ~300 million; Xanadu ~100 million), suggesting that investment activity around QC will continue to grow .

Full report:

https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/quantum-computing-funding-remains-strong-but-talent-gap-raises-concern