2025 Global Overview of Quantum Unicorn Enterprises

2025 Global Overview of Quantum Unicorn Enterprises

1. Report Overview

Released in August 2025, this report offers a comprehensive analysis of global quantum unicorns, quasi-unicorns, and publicly listed former unicorns. It uses a multi-dimensional perspective (covering geography, sub-sector, financing, valuation, etc.) to present the latest developments in the quantum industry, aiming to provide investment-grade insights for investors, entrepreneurs, scientists, and policymakers. Given the quantum industry is still in its early stage, the report also includes qualified quasi-unicorns to broaden the view of innovation in the field.

2. Definitions of Key Entities

2.1 Quantum Unicorn Enterprises

- Established for no more than 10 years, with a post-money valuation of $1 billion or higher in the latest financing round.

- Backed by professional private equity institutions and not yet listed, which ensures cross-industry comparability with unicorn enterprises outside the quantum sector.

2.2 Quantum Quasi-Unicorn Enterprises

- Backed by professional private equity institutions and not yet listed.

- Follow two valuation criteria: post-money valuation of $100 million or higher if established for no more than 5 years, or $500 million or higher if established for 5 to 10 years.

2.3 Publicly Listed Unicorn Enterprises

Refers to companies that were recognized as unicorns before going public and have successfully completed their listing process.

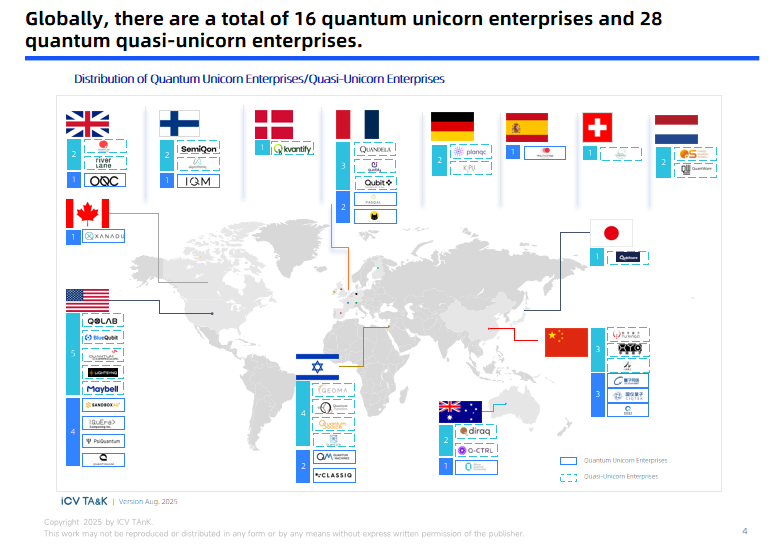

3. Global Distribution of Quantum Unicorns & Quasi-Unicorns

3.1 Quantity & Sector Focus

- Total Count: There are 16 quantum unicorn enterprises and 28 quantum quasi-unicorn enterprises worldwide.

- Dominant Sector: Quantum Computing:

- Unicorns: 14 of the quantum unicorns operate in the quantum computing field (11 in hardware, 3 in software), far more than those in quantum communication & security (1) and quantum precision measurement (1).

- Quasi-unicorns: 27 of the quantum quasi-unicorns are engaged in quantum computing (18 in hardware, 9 in software), 1 in quantum communication & security, and none in quantum precision measurement.

3.2 Geographical Distribution

- Unicorns: Distributed across Asia, Europe, North America, and Oceania. The United States takes the lead in terms of the number and valuation of quantum computing unicorns; China is the only country with unicorns in quantum communication & security and quantum precision measurement; Europe (including France, the UK), Israel, Australia, and Canada also have quantum computing unicorns.

- Quasi-unicorns: Spread across 12 countries. Europe accounts for approximately 50% of global quantum quasi-unicorns; the United States leads with 5 (including the only quantum communication & security quasi-unicorn), followed by Israel (4), and China and France (3 each).

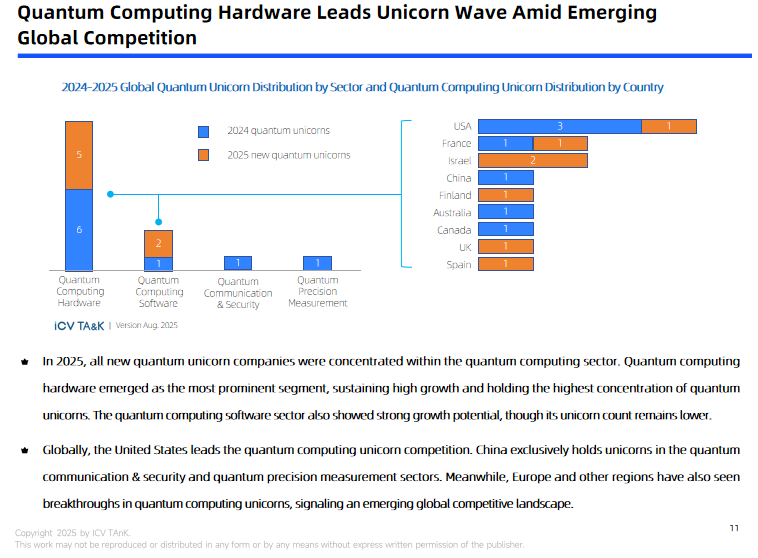

4. Ecosystem Dynamics (2024–2025)

- Promotions: 7 quantum quasi-unicorns (all in the quantum computing sector) were upgraded to unicorn status.

- Industry Reshuffling: 17 new enterprises joined the ranks of quantum quasi-unicorns; 9 quasi-unicorns fell behind in development; 2 quasi-unicorns were acquired; 1 quasi-unicorn ceased to be counted after completing its initial public offering (IPO).

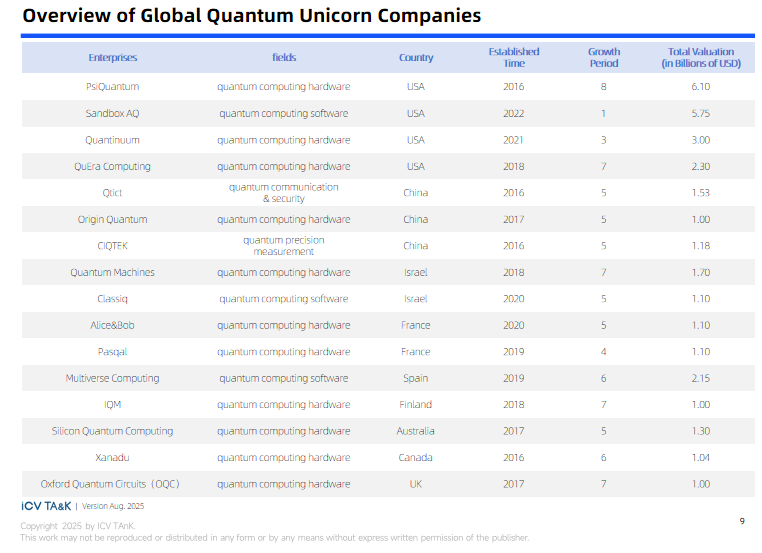

5. Financing & Valuation

5.1 Quantum Unicorns

- Funding Rounds: 63% of the latest financing rounds of quantum unicorns were Series B or Series C (6 in Series B, 4 in Series C), with 2024–2025 being a pivotal period for concentrated funding.

- Valuation: Quantum computing software unicorns have the highest average valuation at $3.0 billion; the United States dominates the global quantum computing unicorn valuation with an average of $4.29 billion, followed by Spain ($2.15 billion), Israel ($1.40 billion), Australia ($1.30 billion), and China ($1.24 billion).

5.2 Quantum Quasi-Unicorns

- Funding Rounds: 79% of the latest financing rounds of quantum quasi-unicorns were Series A or earlier (18% in Seed stage, 61% in Series A), with continuous capital injection into the sector during 2024–2025.

- Valuation: The United Kingdom ($0.64 billion) and Switzerland ($0.60 billion) lead Europe in terms of quantum quasi-unicorn average valuation; most quasi-unicorns in the United States are in the early-to-mid-stage of development, resulting in lower average valuations, which reflects the maturity of the U.S. quantum market.

6. Publicly Listed Former Quantum Unicorns

6.1 Financial Performance

- In 2024, the net profit of publicly listed former quantum unicorns remained negative, with an average loss of $1.29 billion (an increase of 92% compared to 2023). Some companies achieved revenue growth (e.g., one enterprise saw a 95.41% annual revenue increase), while others experienced revenue declines (e.g., one company had a 54.22% revenue drop).

6.2 Market Performance

- Market Capitalization: Listed companies in the quantum computing field account for 84% of the total market capitalization of all listed former quantum unicorns, reaching $23.116 billion. One leading enterprise has a 2025 market capitalization 6.5 times that of the previous year.

- Stock Prices & Funding: After a correction in the early part of 2025, the stock prices of listed former quantum unicorns rebounded and stabilized starting from April. The total funding raised by these companies from January 2024 to July 2025 reached $2.645 billion; one enterprise secured a $1 billion equity financing, which is the largest single-institution common stock investment in the history of the quantum computing industry.

7. Conclusions & Outlook

- Dynamic Ecosystem: The global quantum industry showed significant growth and high dynamism in 2025, with intense market competition and accelerated natural selection, indicating it is in a phase of rapid development.

- Quantum Computing Dominance: Quantum computing is the core driver of the global quantum unicorn and quasi-unicorn ecosystem. Quantum computing hardware is the most active segment, while quantum computing software, though with fewer enterprises, has greater valuation potential.

- Global Competitive Landscape: A multipolar global competition pattern is taking shape. The United States leads in the number and valuation of unicorns; Europe is growing rapidly with a large number of quasi-unicorns; China has strategic advantages in quantum communication & security.

- Capital Confidence: The capital market remains active in the quantum sector—unicorns mainly raise funds in Series B/C rounds, while quasi-unicorns focus on early-stage financing. The rebound of listed companies reflects market optimism about the long-term prospects of the quantum industry.

- Future Trends: The global quantum industry is accelerating toward commercialization and technological maturity. Synergistic innovation between quantum computing hardware and software will be key to advancing technology and promoting application deployment. While challenges such as technological maturity, business model validation, and profitability remain, enterprises that integrate technology, capital, and talent effectively and pursue continuous innovation will be more likely to succeed.

Report Link:

Contact details

Email: infer@icvtank.com

Website: http://www.icvtank.com/